Whenever I point out that the hyperinflation the usual suspects have been predicting in the United States for the past six years hasn’t materialized, I get a rash of comments declaring that yes it has, the government is just lying about the statistics.

One answer is that independent measures, like the Billion Price Index, aren’t showing results very different from the official index. Still, people will point to the price of something that has gone up as evidence that we have lots of inflation.

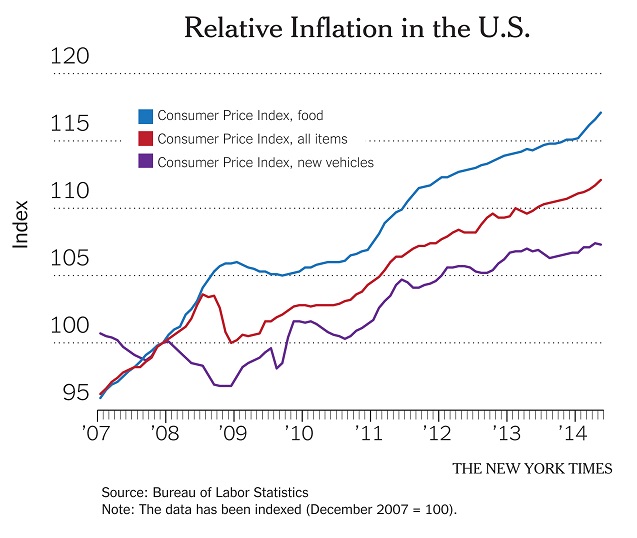

Not that I think such people can be budged, but it is important to realize that relative prices are always shifting around, and that some prices inevitably go up more than the average. As the chart here shows, if you go back to the beginning of the Great Recession, food prices have risen more than the overall Consumer Price Index (although hyperinflation it isn’t), but car prices have risen more slowly (and high-tech stuff has, of course, gotten much cheaper).

And what about Shadowstats, a site that purports to provide true measures of economic variables, and which claims that inflation is much higher than the government lets on? A subscription costs $175 — the same as eight years ago.

The Crank Epidemic

James Pethokoukis, a commentator and blogger at the American Enterprise Institute, and Ramesh Ponnuru, a Bloomberg columnist, are frustrated. They’ve been trying to convert Republicans to market monetarism, but the right’s favorite intellectuals keep turning to cranks peddling conspiracy theories about inflation.

Three years ago it was the Harvard professor Niall Ferguson in Newsweek, citing Shadowstats, a bogus source. Mr. Ferguson was widely ridiculed, by moderate conservatives as well as liberals — but here comes Amity Shlaes of The National Review, making the same argument and citing the same source.

Why this lack of progress?

The answer is that inflation paranoia isn’t a simple misunderstanding that can be corrected by pointing to evidence; it’s deeply embedded in the modern conservative psyche.

According to that worldview, government action must, by definition, have disastrous results; and whatever market monetarists may try to say, their political comrades will continue to lump monetary policy in with fiscal stimulus and Obamacare.

So it’s always the 1970s, if not Weimar, and if the numbers say otherwise, they must be cooked. Evidence has a well-known liberal bias.

Even the rare conservative who is willing to admit that we don’t yet have high inflation won’t admit that this suggests that something is wrong with the models that predicted a huge inflation surge. No, it’s just a miracle.

So market monetarism isn’t going anywhere, politically. It was conspicuously absent in the Eric Cantor-sponsored book of supposed new ideas — and Mr. Cantor himself was knocked out of Congress by a faith-based Randite (which doesn’t make sense, but sense also has a well-known liberal bias.)

Sorry, guys, but you have no home.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.